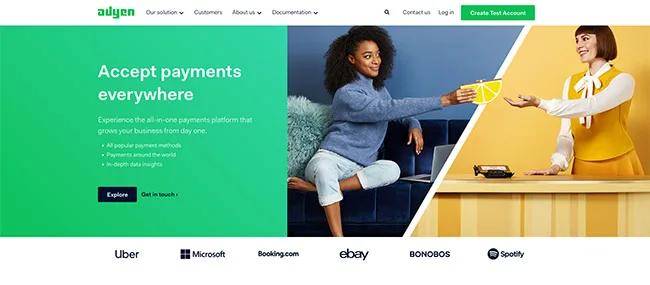

Adyen: The Global Payment Solution for Modern Commerce

Overview

Adyen is a comprehensive payment platform designed for businesses aiming to expand their reach globally. Catering primarily to established enterprises, Adyen offers a seamless payment solution that integrates online, in-store, and in-app transactions.

Ease of Use

While Adyen is packed with features, it leans towards a developer-first approach. This means that while it offers vast capabilities, businesses might need a technical background or assistance to fully harness its potential.

Features

- Adyen Online Payments: Allows integration with websites, mobile sites, or apps, facilitating one-click checkouts and recurring payments.

- Adyen POS Terminals: Offers a range of POS hardware options, from countertop devices to portable ones.

- Adyen Unified Commerce: An omnichannel payment solution that integrates in-store, online, and in-app sales.

- Global Processing: Supports a multitude of payment methods globally, making it ideal for businesses aiming for an international presence.

- Additional Features: Includes risk management tools, dynamic reporting, extensive developer documentation, and support for gift cards.

Pricing

Adyen’s pricing varies based on the region, country, and payment type. In the US, it offers a mix of interchange-plus pricing and flat rates. For instance, Visa and Mastercard transactions come with a fee of $0.12 and are charged on an interchange++ basis, while American Express and Discover have a flat rate of 3.95% plus a $0.12 fee. There are also additional fees for other payment methods and services.

Customer Support

Adyen provides global tech support via email, web, and phone during business hours, with 24/7 emergency support. Their website is a rich source of information, from developer documents to product descriptions.

Popularity

Adyen is a preferred choice for big-name clients operating on a global scale, including brands like eBay and Microsoft. However, its appeal to small businesses is mixed due to its technical requirements and pricing structure.

Pros

- Tailored for international merchants.

- No setup, application, or monthly fees.

- Offers both interchange-plus and flat-rate pricing.

Cons

- A required monthly minimum might be a hurdle for some businesses.

- Not suitable for high-risk merchants.

- Mixed customer reviews, with some highlighting issues with customer service and hidden fees.

Overall Rating

4/5 – Adyen offers a robust payment solution, especially for businesses aiming for a global footprint. However, its technical requirements and mixed reviews make it a platform that businesses should approach with a clear understanding of their needs.